Thailand properties investments allows you to benefit from very interesting returns. This profitability is linked to the Thai economic dynamism but is also fueled by a very attractive tax system.

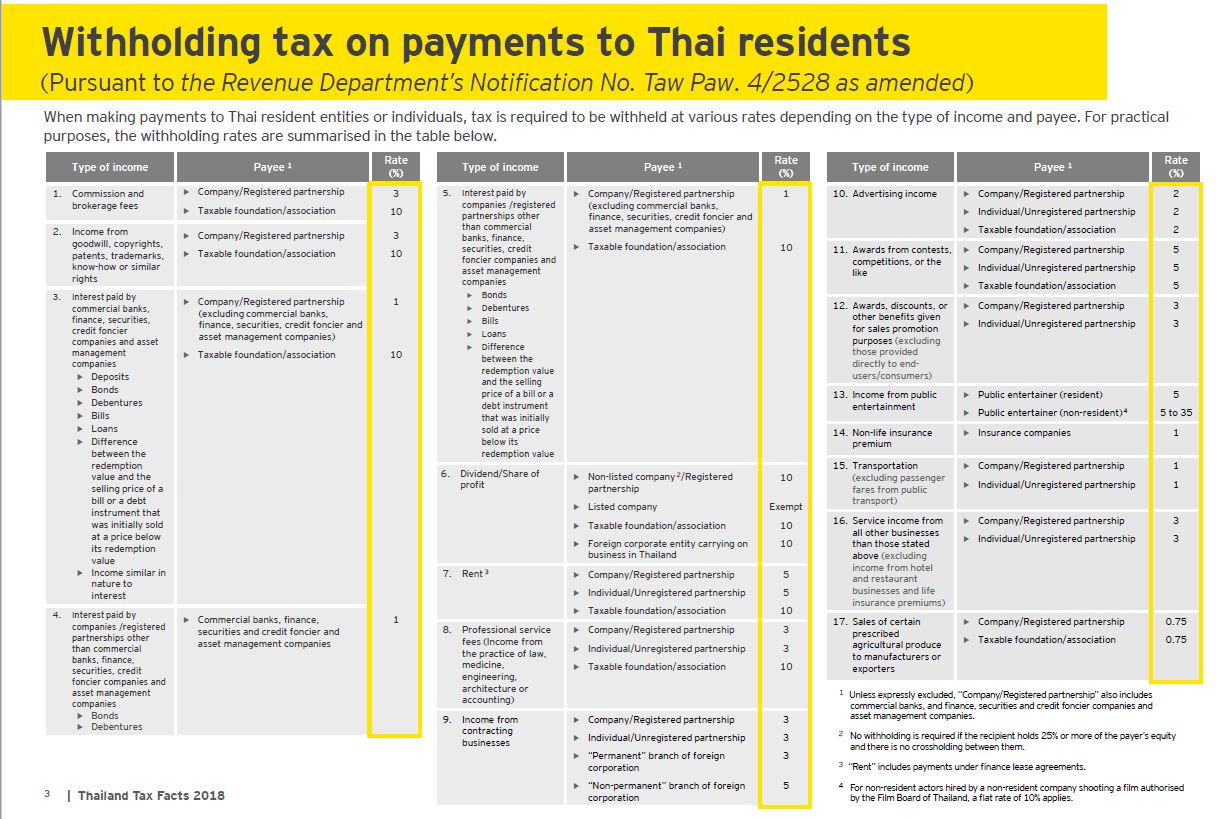

Property development and/or hotel management companies paying investors guaranteed rental income deduct a “Withholding tax” from this amount, which varies from 3 to 15% depending on the case.

Translated in several ways (“withholding tax”, “tax at source”), this principle of taxation is widely practiced in Thailand, on several types of payments.

The principle is that any company making a payment of taxable income to another company or an individual must deduct from the payment a percentage of the amount to be paid and pay the equivalent to the tax authorities. In this way, the payer pays tax “in advance” in place of the recipient.

The Withholding tax is in fact an advance payment of income tax, which means that the Withholding tax amounts already deducted from the payments received are also deducted from the taxes payable at the end of the year (with proof of the amounts paid).

If the amount of withholding tax paid is higher than the tax due, you can claim a refund of the overpayment.

The most common Withholding tax rate is 3% : this applies to all services, commercial promotions and rewards.

The rate of 5% mainly concerns rents. Please note that these rates are valid for the owners of a fiscal identity in Thailand (tax ID). For non Thai residents and without Tax ID, the rate is 15% whatever the nature of the payment.

In the case of a real estate investment, guaranteed rental income can be considered in two different ways. The most common is to declare them as rent: the withholding tax is therefore 5% if you have a Tax ID in Thailand or 15% otherwise.

But the guaranteed income from a property under hotel management differs from a normal rental: some promoters declare it as a “reward, promotion and other benefit from a commercial action”. In this case, the withholding tax rate will be 3% with a tax ID in Thailand.

In any case, without tax ID, the Withholding tax rate for a real estate purchase will be 15%.

The table below summarizes the different applicable rates.

A person who has received rental income in Thailand is obliged to declare it to the Thai tax authorities and pay the corresponding income tax.

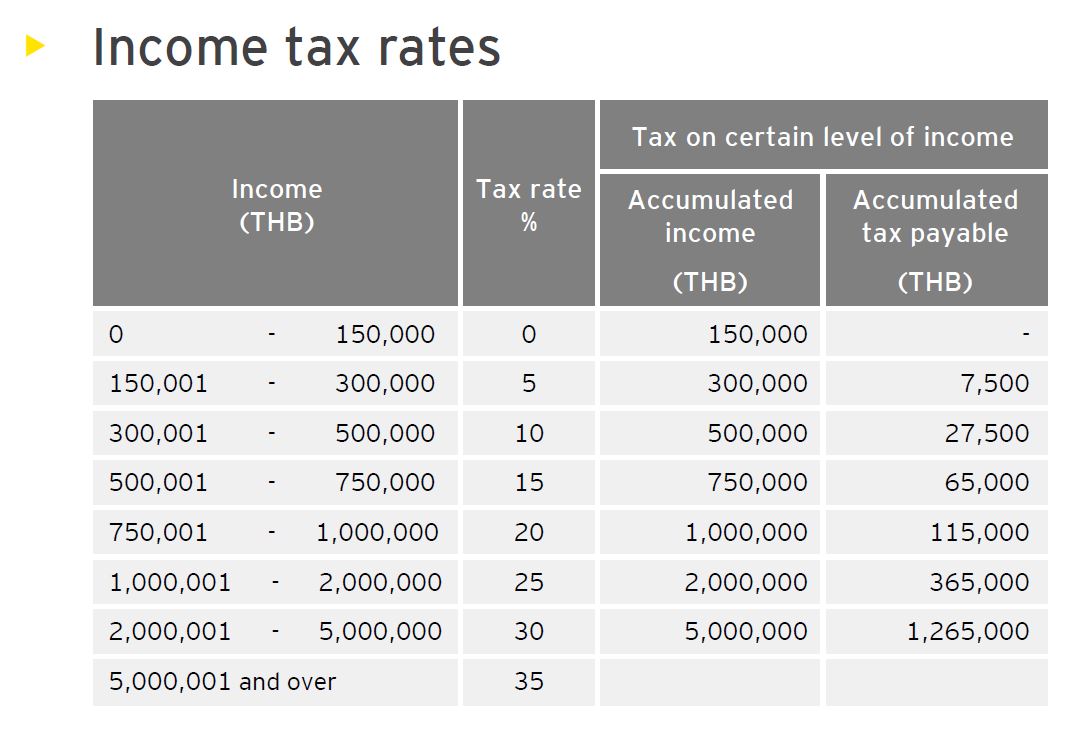

The income tax scale in 2020 is as follows, bearing in mind that a certain number of deductions apply.

As explained above, if the Withholding tax from the rental income exceeds the amount of income tax, a refund procedure is possible.

The following examples illustrate this :

Example 1: THB 4,000,000 investment

You invest THB 4,000,000 in an apartment with a contractually fixed rental yield of 7%, i.e. THB 280,000 per year.

Without tax ID or bank account in Thailand, you are subject to the 15% Withholding tax rate, i.e. THB 42,000 deducted by the developer and paid to the tax authorities. So you actually receive THB 238,000 per year.

After registering your income with the tax authorities, your taxable income – after deduction of personal allowances and deductible expenses – turns out to be THB 136,000, i.e. below the minimum bracket of THB 150,000.

This means that your income is not taxable (or taxable at 0%): you can claim the full THB 42,000 refund of the Withholding tax.

Example 2: Investment of THB 8,000,000

You invest THB 8,000,000 in an apartment with a contractually fixed rental yield of 7%, i.e. THB 560,000 per year.

Without tax ID or bank account in Thailand, you are subject to the 15% Withholding tax rate, i.e. THB 84,000 deducted by the developer and paid to the tax authorities. So you actually receive THB 476,000 per year.

After registering your income with the tax authorities, your taxable income – after deduction of personal allowances and deductible expenses – turns out to be THB 332,000.

According to the bracket tax scale, THB 150,000 of this amount is taxable at 5% and THB 32,000 at 10%. You will owe THB 10,700 in taxes.

This means that you can claim a refund of 84,000 – 10,700 = THB 73,300 from Withholding tax.

A new law that came into force in 2020 introduces a property tax that replaces the former “Land & House tax” (which, at 12.5% of rental income, was very little applied).

The new law provides for many different situations depending on the type of asset (land, residential property, vacant property, rental property) and the rates also vary according to the value of the property. It is important to note that the rate applicable to a property owned for rental use and worth less than THB 50 Million is 0.3% (Source: Orbis article published in Le Petit Journal in March 2019).

If we take the example of a property with a net rental yield of 7% per year, the impact of this tax remains limited, bringing the yield down to 6.7%.

It should also be noted that investors who acquire a property in “Leasehold” are not liable for this tax because they are not landowners (unless their contract includes a specific clause, which may be the case for houses for example).

For a purchase in Leasehold or Freehold it is necessary to pay transfer fees for registration at the Land Department.

In Leasehold, these fees amount to 1.1% of the value declared in the lease contract.

In Freehold, the transfer fees amount to 2% of the value of the property.

In Thailand, there is no the house tax. There is locally the equivalent of the tax on household waste, but the amounts are small (a few dozen euros per year).

There is no inheritance tax below 100 million THB.

A law adopted in 2015 introduced inheritance tax on real estate assets. However, these are low and only apply to assets in excess of 100 million Bahts (about 3 million euros).

Thailand and your country may have a Double Taxation Treaty which states that income from real estate is taxable in the Contracting State where the property is located.

In that case, when buying an apartment or a house in Thailand, it will be Thai taxation only which will apply on Thai rental income.

However, if you are a US citizen or if your country does not have such a treaty with Thailand, you will need to check with the competent authorities and lawyers of your home country. Other rules may apply regarding the declaration of foreign income that you will need to take into account.

DISCLAIMER : All the information contained in this FAQ is given for information purposes only and is not official information. It is a popularization of problems, some of which (property law and taxation in particular) require the opinion of experts and individual treatment on a case-by-case basis. Although TPG has produced this content in good faith, with the aim of providing information that is as accurate as possible, it cannot be held responsible if certain information proves to be inaccurate.